Interest Rates Force an Execution Change

Rising interest rates have increased the cost-of-capital for all fintech vendors. Public company valuations are down. The tech-heavy NASDAQ is down 27% in the last year. Private company valuations are way down. Some firms have lost 80% or more of their value in follow-on funding rounds. The PYMNTS.com index below of FinTech IPO Performance is down 49% YTD and 74% from its high in February, 2021.

It is expensive (or, in some cases impossible) for a fintech vendor to raise money. All fintech vendors need to conserve cash compared to the last decade. Boards and investors are requiring them to become cash positive or profitable. They are also demanding current business plans that create scale, not just expansion.

The Challenge for Growth Execution

The need for profit via scale has created another challenge to the successful execution of growth strategies: picking the highest priority market(s) and product(s) that will be the mid-term focus of the firm. The struggle is acute at smaller fintech vendors and divisions of larger firms.

Most younger firms – and younger products at larger firms – have made it past infancy by proving that there are buyers. Usually, those sales are to whichever market segments will make the purchase. The need was to prove demand. Many times, those early deals are at least partially custom, in order to close the deals. What the vendor ends-up with is having sold a couple (or more) in multiple markets with multiple editions of its product.

Being in several combinations of markets and products, the business is not setup to scale, so it must prioritize its investments. Sales and marketing resources are being spent in several places, and product development/enhancement is happening for a number of products. The business is simply doing too many things that are not repeatable. That lack of focus and scale requires more cash to be burned, and profits are elusive, all of which is unacceptable in current capital markets.

There are proven ways to deal with this challenge.

Market-Product Prioritization Method

The following approach will result in an inventory of existing and new markets and products. Markets and products will be matched in pairs (“product X in market Y”) and tagged with whether they are (1) part of the existing business, (2) an opportunity for new revenue, or (3) out-of-scope for growth over the planning horizon. Each market-product is a potential revenue source subject to the evaluation in this method.

At a high-level, an assessment of the payoff from each of the in-scope market-product pairs, and the effort associated with capturing those pockets of revenue is developed and used to determine the priority scheme.

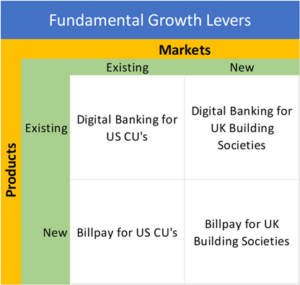

The foundation of this method is represented via the simple example below, considering a digital banking vendor serving US CU’s. Fundamentally, a business can grow in two ways, (1) sell new products to existing markets (e.g., “Billpay for US CU’s”), or (2) sell existing products to new markets (e.g., “Digital Banking for UK Building Societies”).

While it is possible to sell new products to new markets (e.g., “Billpay for UK Building Societies”), that is a high-risk, resource-/cash-intensive strategy. That notwithstanding, this is where young companies/divisions find themselves, having sold “a little here and a little there” in pursuit of proof-of-demand. That is the issue that this methodology will mitigate.

Create an Inventory of Potential Revenue Sources

Time Horizon

Setting the priority markets and products must be undertaken over a time horizon, like 3 years. The priorities will be a firm commitment over the planning horizon, as of the date of the exercise. In other words, in a quarter or a year, if new, compelling information is learned, the priorities can be reset. In fact, there should be a periodic review put in place to update the assessment. Likewise, at some point into the time horizon, the priorities will have to recalibrate for year N+1.

Itemizing Markets

The fintech vendor can start by making a list of the market verticals it is currently in or might be over the time horizon. They should each be tagged as an existing, new, or out-of-scope market.

The existing market(s) should be defined as those with considerable revenue which are likely to continue to be material. The vendor is making and will continue to make substantial effort to succeed in these markets. So, a few opportunistic deals here and there are not part of the existing market(s).

In terms of granularity, a segment is defined as a group of buyers that has identical needs (including non-functional needs, not just software needs). As with the rest of this methodology, judgement calls are often good enough assuming the vendor knows the segments’ needs. As examples:

- For a billpay product, FI’s under $500mm will have different needs than those over $100bn, but the needs of smaller banks vs. credit unions might be similar enough to consider them a single market segment

- For a loan origination system, bank and non-bank lenders may have many of the same needs, but the differences in compliance and regulatory oversight may suggest that they be different segments.

Itemizing Products

Like markets, the vendor lists all the products it has sold and is selling. Again, granularity is a judgement call, and the intent is to avoid dropping to the feature-level. Products can be defined as things that can be purchased on their own. As with markets, they should be tagged as existing, new, or out-of-scope with existing meaning that significant revenue is involved.

Itemizing Use-Cases

This exercise isn’t actually 2-dimensional (market/product). The third dimension is the use-cases within a market. It is best to consider this issue in terms of the customer journey of the fintech vendors’ clients’ customers. As an example, if a cloud-core vendor has a solution to enable lenders to service borrowers, that solution may or may not be compelling for loan origination. In that case, servicing would be considered an existing use case and origination would be considered new.